hankyoreh

Links to other country sites 다른 나라 사이트 링크

Luxury consumption on 20s-somethings on the rise

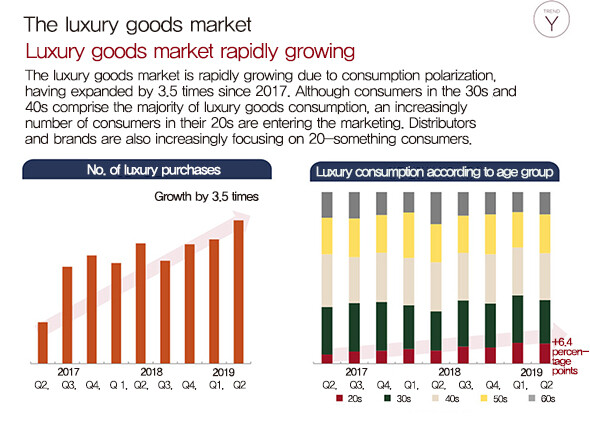

A “consumption polarization” phenomenon has been emerging in South Korea: people who economize on everyday consumption through low-cost purchases then use the difference to purchase luxury items. Luxury consumption has been growing in particular among those in their 20s, who emphasize “consumption for self-satisfaction,” an analysis shows.

A report on luxury item purchases published on Nov. 28 by Lime, a research platform for Lotte Members, showed the number of luxury item purchases during the second quarter of 2019 (April to June) to be 3.5 times higher than for the second quarter of 2017. The figure stands in contrast with the declines observed for clothing and sundries at department stores, which have been the chief distribution channel for luxury items. According to Ministry of Trade, Industry and Energy (MOTIE) figures, sales for noted overseas brands at Lotte, Shinsegae, and Hyundai department stores last year rose by 10.5% from the year before, while declines were observed in sales of women’s casual items (-4.0%), sundries (-5.9%), and children’s sports items (-1.6%).

The percentage of luxury items among department store sales rose from 13.5% in 2016 to 23.5% as of late September 2019. In effect, the luxury items are drawing customers into brick-and-mortar establishments.

“We’ve been seeing a trend of consumption polarization, where people are using the money they save from low-priced daily essentials toward luxury item consumption,” a department store industry source explained.

“There’s still a strong preference for offline sales of luxury items because of authenticity verification and face-to-face services, so there’s been an emphasis on using luxury items to lure consumers to brick-and-mortar retailers,” the source said.

The luxury consumption has been driven by consumers in their 20s. In the case of Lotte Members, the number of purchases by 20-somethings has risen by 7.5 times in two years, with the age group’s percentage of purchases rising from 5.4% to 11.8%. Similar increases in luxury sales to 20-somethings were observed at Shinsegae Department Store (26.9% for January-November 2019) and Hyundai Department Store (29.1%, January-October).

20-somethings place less value on brand name when purchasing luxury itemsAlso visible is a trend of “serious consumption.” When asked what they emphasize when purchasing luxury goods (multiple responses allowed), consumers named “practicality” in second place (32.8%) after “design” (63.3%), while the “name of the brand” was listed fourth at 26.2%. This contrasted with the trends observed among consumers in their 30s and 40s, who had the brand name listed in second or third place. A strong preference was also observed for items in a relatively low price range or with a high level of daily usability, including wallets (34.2%), card wallets (25.1%), and sneakers (23.1%). A trend of what has become known as “nasimbi” -- a Korean coinage meaning “consumption for one’s own satisfaction” -- was clearly in evidence, and analysts also pointed to the effect of a “flexing” culture on social media.

In reflection of this trend, businesses have been shifting their product and sales strategies over the past several years to cater more to shoppers in their 20s. Brands like Gucci and Balenciaga have been marketing ugly shoes in the 900,000-1,000,000 won (US$761.61-846.21) range and operating pop-up stores. A Shinsegae Department Store source explained, “They’re working to broaden their base while maintaining their luxury image through things like quality sneakers, which have garnered a strong response from 20-somethings.”

Lotte Department Store has been working to introduce brands targeting 20-something customers into its luxury section, including MSGM, Off-White, Duvetica, and Ienki Ienki.

“We’ve been lowering the entry barriers for people in their 20s by getting rid of traditional luxury brands like Dolce & Gabbana or Philipp Plein,” explained a Lotte Department Store source. Since 2007, Shinsegae Department Stores and others have been creating new “VIP” levels for customers with annual purchases of at least 4 million won (US$3,385).

By Hyun So-eun, staff reporter

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] Is Korean democracy really regressing? [Column] Is Korean democracy really regressing?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0705/2917201664129137.jpg) [Column] Is Korean democracy really regressing?

[Column] Is Korean democracy really regressing?![[Column] How tragedy pervades weak links in Korean labor [Column] How tragedy pervades weak links in Korean labor](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0703/8717199957128458.jpg) [Column] How tragedy pervades weak links in Korean labor

[Column] How tragedy pervades weak links in Korean labor- [Column] How opposing war became a far-right policy

- [Editorial] Korea needs to adjust diplomatic course in preparation for a Trump comeback

- [Editorial] Silence won’t save Yoon

- [Column] The miscalculations that started the Korean War mustn’t be repeated

- [Correspondent’s column] China-Europe relations tested once more by EV war

- [Correspondent’s column] Who really created the new ‘axis of evil’?

- [Editorial] Exploiting foreign domestic workers won’t solve Korea’s birth rate problem

- [Column] Kim and Putin’s new world order

Most viewed articles

- 110 days of torture: Korean mental patient’s restraints only removed after death

- 2[Column] Is Korean democracy really regressing?

- 3Real-life heroes of “A Taxi Driver” pass away without having reunited

- 4What will a super-weak yen mean for the Korean economy?

- 5Former bodyguard’s dark tale of marriage to Samsung royalty

- 6Koreans are getting taller, but half of Korean men are now considered obese

- 7Democrats ride wave of 1M signature petition for Yoon to be impeached

- 8Democrats seek to impeach 4 prosecutors, including those tied to probes into Lee Jae-myung

- 9[Photo] Twitter now lets users decide who can reply to their tweets

- 10[Reportage] Inside some of Korea’s 1,067 small towns facing extinction