hankyoreh

Links to other country sites 다른 나라 사이트 링크

S. Korea, Japan poised to resume currency swaps, this time in US dollars

South Korea and Japan were scheduled to sign a currency swap deal on Thursday for the first time in eight years since 2015.

The swap in question is likely to be based on the US dollar rather than the won and yen. Amid reports that the amount would be in the range of US$2 billion to US$10 billion, analysts predicted the dollar base would mean an equivalent effect to a currency swap deal between South Korea and the US.

Multiple high-ranking government officials said Wednesday that the South Korea-Japan currency swap to be discussed at a meeting of the two sides’ financial ministers on Thursday was likely to be based on the US dollar. In terms of scale, they say the discussions would start at the minimum level of past swaps between the two sides.

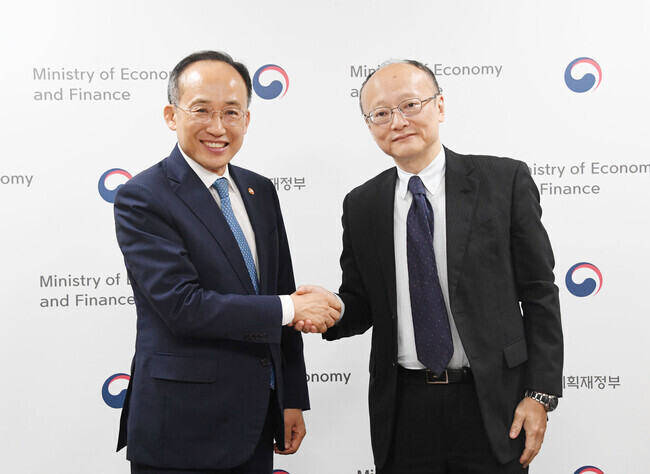

Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho was scheduled to discuss the terms with his Japanese counterpart Shunichi Suzuki on Thursday in Tokyo at the eighth meeting of the two sides’ finance ministers — the first in seven years.

Kyodo News and other Japanese news outlets reported Wednesday that final efforts were underway to coordinate an agreement on resuming currency swaps between South Korea and Japan. They also said an announcement would come after the two sides had reached an agreement on specific details, including the scale and duration of the swap.

The two countries signed their first currency swap agreement in 2001. It started with US$2 billion, and additional agreements followed, the currency swap balance growing to US$70 billion by 2011. But when relations between South Korea and Japan chilled due to diplomatic conflicts, the swap deal between the two expired in February 2015 and had remained in that state until now.

Notably, this time, the swap being discussed would be in dollars rather than won and yen. If the two countries sign a dollar-based currency swap deal, they can each exchange won with dollars held by Japan and yen with dollars held by South Korea at certain rates during emergencies. Compared to a yen-based swap, this is much more efficient in terms of liquidity as dollars can be received directly; plus, as Japan has an indefinite, unlimited swap pact with the US, analysts say it is akin to an expansion of the currency swap agreement between South Korea and the US.

Only, as both countries are not in urgent need of dollars, it is projected that the coming currency swap will not be significant in scale. The symbolism of the two countries reopening a channel for economic cooperation that can be utilized in crises is more significant. The Ministry of Economy and Finance commented that agendas for bilateral cooperation such as a South Korea-Japan currency swap “have yet to be decided and agreed upon.”

By Cho Kye-wan, senior staff writer

Please direct questions or comments to [english@hani.co.kr]

Editorial・opinion

![[Column] How opposing war became a far-right policy [Column] How opposing war became a far-right policy](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0702/5017199091002075.jpg) [Column] How opposing war became a far-right policy

[Column] How opposing war became a far-right policy![[Editorial] Korea needs to adjust diplomatic course in preparation for a Trump comeback [Editorial] Korea needs to adjust diplomatic course in preparation for a Trump comeback](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0702/9717199086060096.jpg) [Editorial] Korea needs to adjust diplomatic course in preparation for a Trump comeback

[Editorial] Korea needs to adjust diplomatic course in preparation for a Trump comeback- [Editorial] Silence won’t save Yoon

- [Column] The miscalculations that started the Korean War mustn’t be repeated

- [Correspondent’s column] China-Europe relations tested once more by EV war

- [Correspondent’s column] Who really created the new ‘axis of evil’?

- [Editorial] Exploiting foreign domestic workers won’t solve Korea’s birth rate problem

- [Column] Kim and Putin’s new world order

- [Editorial] Workplace hazards can be prevented — why weren’t they this time?

- [Editorial] Seoul failed to use diplomacy with Moscow — now it’s resorting to threats

Most viewed articles

- 110 days of torture: Korean mental patient’s restraints only removed after death

- 2[Editorial] Korea needs to adjust diplomatic course in preparation for a Trump comeback

- 3Nine dead in Seoul after car plows into pedestrians

- 4[Column] How opposing war became a far-right policy

- 5Korea to create dedicated population strategy ministry to combat low birth rate, aging society

- 6[Editorial] Silence won’t save Yoon

- 7Samsung Electronics workers to go on first strike in company’s 55-year history

- 8Son Heung-min’s father, brother accused of child abuse at football academy

- 9Dreams of a better life brought them to Korea — then a tragic fire tore them apart

- 10Japan is building a military meant for more than self-defense — and has the US to thank for it